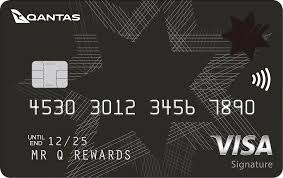

The Qantas Rewards credit card from NAB in Australia is absolutely amazing for anyone who loves to travel and wants to maximize their rewards!

If you’re the type who dreams of accumulating miles to fly more frequently or to enjoy incredible upgrades on your flights, this card is a total game-changer. With every dollar spent on daily purchases, you earn Qantas Points, which can be redeemed for flights, luxury hotel stays, car rentals, and even exclusive experiences!

On top of that, the card offers additional benefits like travel insurance, giving you peace of mind on your adventures, and frequent bonus point promotions—sometimes you can earn enough points for your next trip right away!

With NAB’s Qantas Rewards, it’s like every purchase you make is taking you closer to your next dream destination. What could be better than turning your everyday spending into unforgettable journeys?

Advantages

The Qantas Rewards credit card from NAB in Australia offers several benefits for those looking to accumulate points and travel-related perks. Here are some of the key advantages:

-

Earning Qantas Points: For every dollar spent using the card, you earn Qantas Points, which can be redeemed for flights, flight upgrades, hotel stays, car rentals, and other products and experiences offered by Qantas.

-

Bonus points: Depending on the current promotional offer, you can earn extra points when signing up for the card. Often, these initial points are enough to redeem a flight or get a significant discount.

-

Travel insurance: The card provides complimentary travel insurance, which can cover medical expenses, flight delays, lost luggage, and other unexpected issues during your trips.

-

Access to exclusive promotions: Cardholders gain access to special promotions such as discounted flights, upgrade offers, and exclusive Qantas member events.

-

No foreign currency conversion fees: Perfect for frequent international travelers, the card allows purchases in other currencies without conversion fees, saving on international transactions.

-

Flexible rewards: In addition to using Qantas Points for flights, you can redeem them for a wide variety of products, services, and experiences in the Qantas Store.

-

Fraud protection: The card is equipped with advanced security technology to protect your transactions against fraud and unauthorized use.

-

Exclusive benefits for frequent travelers: Depending on the card level, you may gain access to Qantas VIP lounges, priority boarding, and other perks that make your travel experience more comfortable.

These benefits make NAB’s Qantas Rewards card an excellent option for anyone who loves to travel and wants to maximize the value of their everyday spending!